Scoring UK Commercial Property Fire Risk: Part 2

5 Minute Read

An Insurance Risk Perspective

The Addresscloud Fire Risk Model

Whilst the fire incident data introduced in our first post provides an appealing glimpse into the potential fire risk presented by commercial buildings, there are significant external influencing factors that must be accounted for before we can reach a realistic fire risk score. These include:

1. Total population of commercial buildings and their type distribution,

2. Physical dimensions such as number of floors and height,

3. Adjacency of other building types,

4. Sprinkler and other fire measures,

5. Distance to nearest fire station and calculated drive time.

For example, fires at retail locations are some of the highest recorded in comparison with other building uses. So on this basis alone you might think all retail locations warrant a High or even Extreme score. However, when you consider the total number of retail locations (400,000+) as a whole across the UK the probability of a fire in a retail location when compared to all other commercial locations is actually very low.

Additional research by fire extinguisher manufacturers has identified commercial buildings that pose significant fire risk (see list below), and by being able to identify these individual premises we are able to refine and strengthen our risk scoring.

High risk commercial premises:

1. Restaurants and Takeaways,

2. Homes of Multiple Occupancy (HMOs),

3. Bars and Nightclubs.

These interrelated factors make for a highly complex, multi-faceted model to realistically score the fire risk potential of commercial properties.

At Addresscloud we have examined and accounted for these and a number of other factors in our scoring model to the extent that we now see fire risk not just from the perspective of the premise but way beyond the premise too. This enables insurers to a have a much wider perspective and access a more realistic fire score than one simply based on the premise alone.

The Addresscloud model has scored some 2.3m commercial properties across the UK with a straightforward 1 to 5 score; 1 being Negligible risk and 5 being Extreme risk. The figure below graphically shows our model. For example, we can see that some 4% of commercial properties have been scored as 5 (Extreme risk) and some 30% have been scored a 4 (High risk)

An example of where this complexity is played out can be seen with banks in complex commercial centres that often have fast food outlets in the same building. Banks are considered low risk, due to low fire incidents, fire suppression systems often being installed and no eating or cooking activities taking place on the premise.

However, many banks are often situated in or around shopping centres, along high streets, etc. where they are surrounded by takeaways/bars/restaurants and owing to that adjacency become a much higher risk.

Risk Adjacency

In 2019 the Belgrave Commercial Centre in Leicester was destroyed by fire. This contained a bank, other retail outlets and several restaurants; one of the restaurants was the cause of the fire.

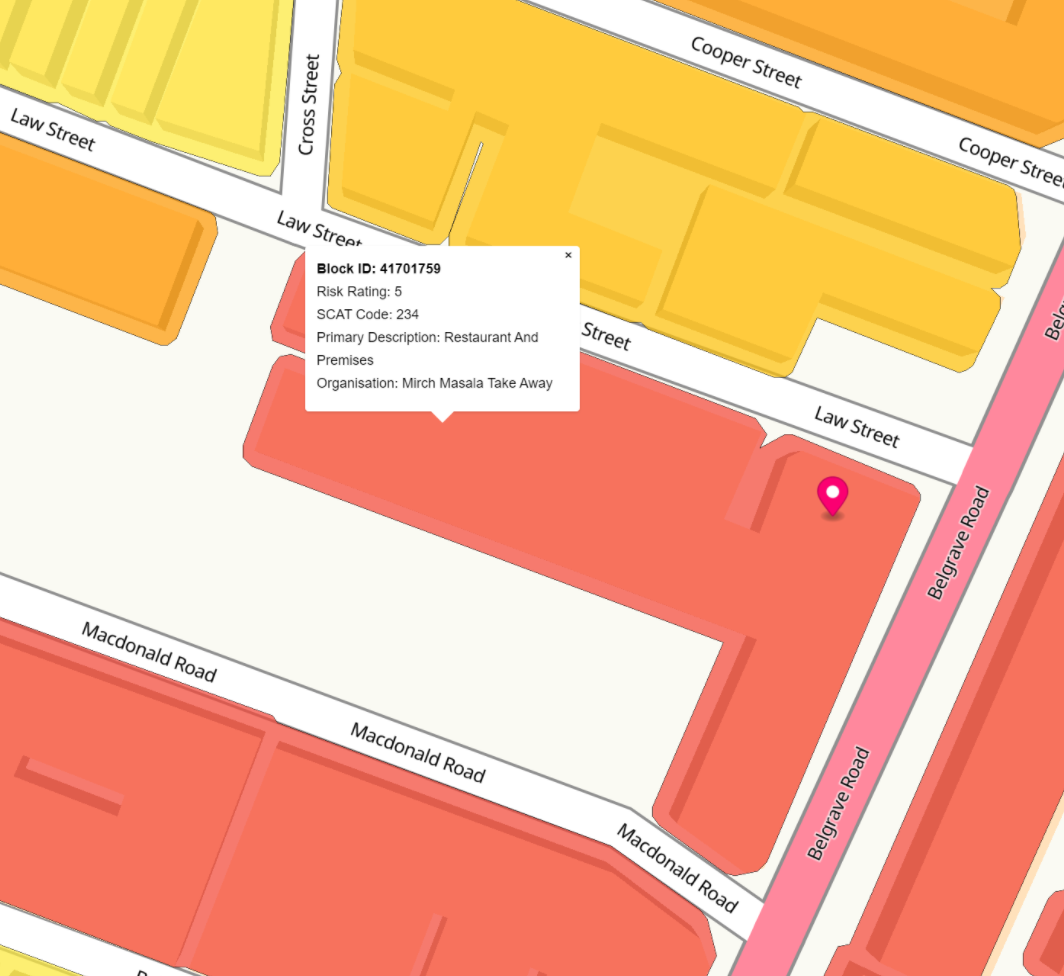

The map below shows how Addresscloud views that risk today. The HSBC bank is graded as a Negligible risk however the fire block as a whole (remember the fire block is created from all buildings that are within 5m of each other) is graded as a High risk because of a Takeaway in the same block.

Since that date the restaurant has closed and not been replaced so the risk profile of this block has now changed from Extreme to High.

This demonstrates the importance of Fire blocks for considering the fire score of connected and adjacent premises along with the individual premise in question.

Model Validation

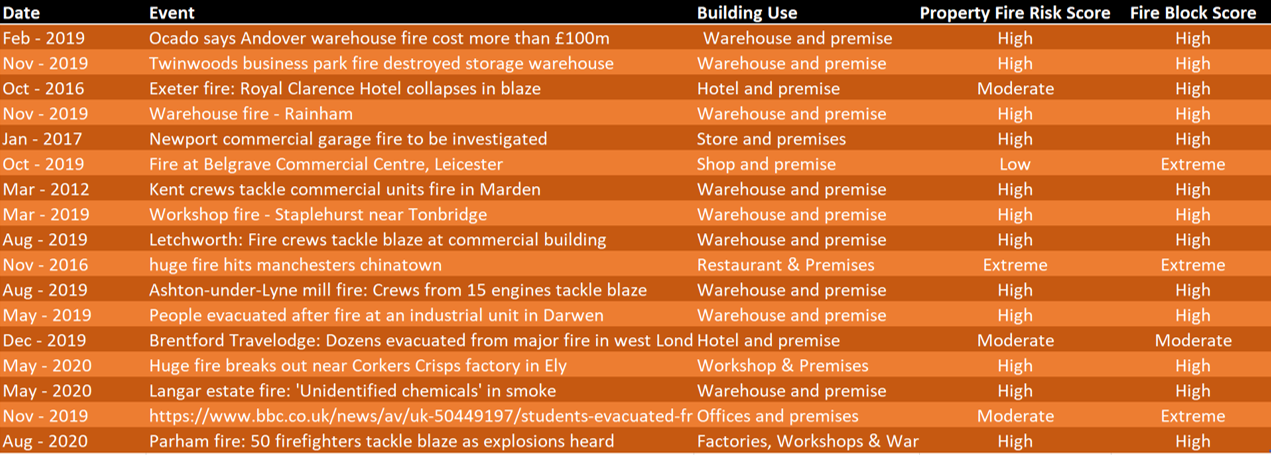

When looking at a wider range of fires a good correlation is evident between Addresscloud fire risk scores and actual reported commercial fires.

Whilst commercial fires are significantly less in number than domestic fires their individual resulting costs are orders of magnitude greater. For example, the insurance payout for the Ocado fire cost were in excess of £100m and The Royal Clarence Hotel £23.3m.

Further work is ongoing to examine additional fire data and compare model scores against additional real world examples. Future improvements will include further risk differentiation for key risk types such as food & takeaway establishments, and warehouse and storage units.

Summary

Addresscloud’s fire risk model is based on some 200,000+ fire incidents recorded by the UK’s fire services at commercial premises between 2010 and 2019.

When analysed and further modelled against additional external influencing factors a fire risk score is computed to account for the risk at the premise and wider to the adjacent connected properties.

Even with improvements in sprinkler installations, fire prevention technology, increased education by Fire Services and the insurance industry, commercial fire risk is costly risk to insurers. Addresscloud's risk model, whilst not definitive, does provide a realistic and straightforward risk score to help insurers better understand and manage their risk exposure.

The fire risk score is part of Addresscloud's Intelligence API, which is built on top of our world-class geocoder and provides over 200 property data-points with address-level accuracy, helping insurers make better decisions, faster. Our new fire scoring enhances our intelligence API to help UK insurers price and write fire-risk with greater insight across some 2.3m UK commercial properties.

Free Trial

To trial our Addresscloud commercial fire scores model, please get in touch with our team hello@addresscloud.com

Addresscloud in Action

See how Addresscloud services are helping our customers solve real-world challenges.